The Importance of Credit Scores and How to Improve Yours

Understanding the importance of credit scores and learning effective strategies to improve yours can lead to better financial opportunities.

Understanding Credit Scores

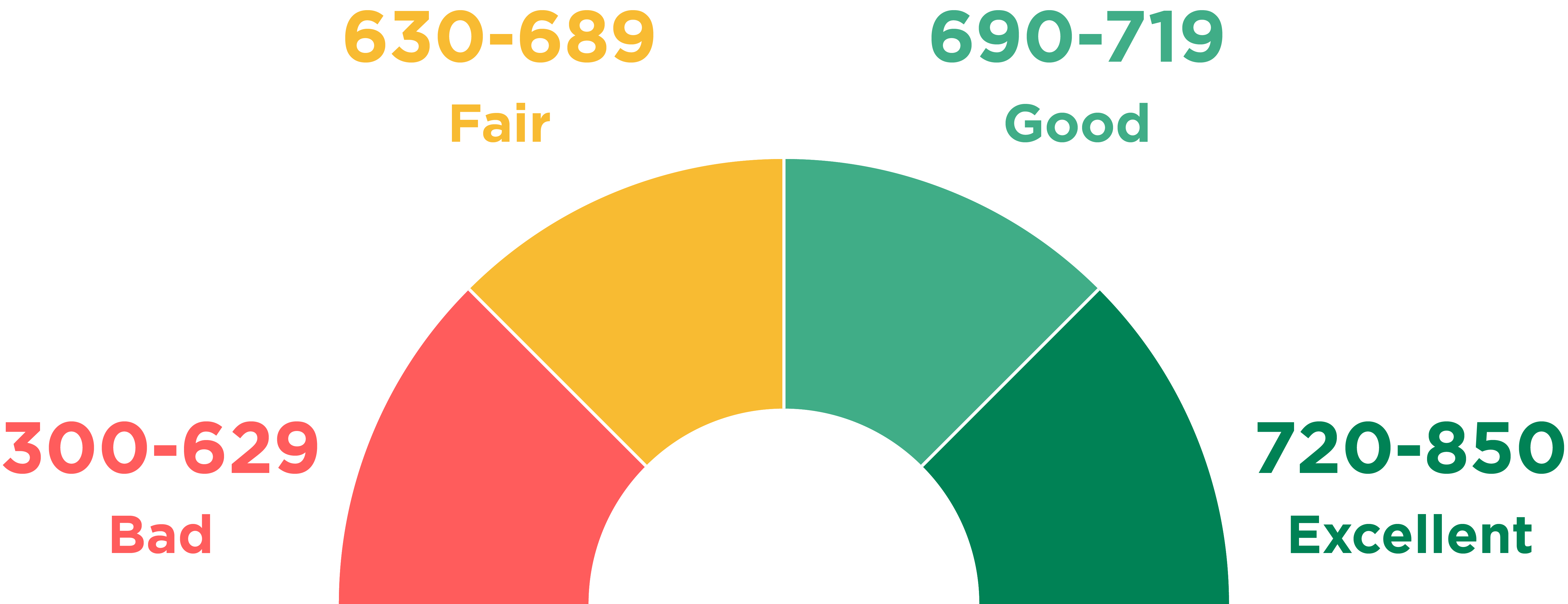

Credit scores are numerical representations of your creditworthiness, ranging typically between 300 and 850. These scores are calculated based on your credit history, including your payment history, the amount of debt you have, the length of your credit history, the types of credit you use, and any new credit inquiries. A high credit score can open doors to better interest rates on loans and credit cards, while a low score can limit your financial options. Understanding how your credit score is calculated is the first step in managing and improving it.

Why Credit Scores Matter

Your credit score affects many aspects of your financial life. Lenders use it to determine the risk of lending you money, which influences whether you'll be approved for loans or credit cards. A higher score can result in lower interest rates, saving you money over time. Additionally, some landlords and employers check credit scores to assess reliability. Therefore, maintaining a good credit score is essential not just for borrowing but for various aspects of your life.

Factors That Affect Your Credit Score

Several factors contribute to your credit score, with payment history being the most significant. Late payments can drastically lower your score. The amount of debt you owe relative to your credit limit, known as credit utilization, also plays a crucial role. The length of your credit history matters as well; longer histories generally result in higher scores. The types of credit you use and recent credit inquiries can also impact your score. Understanding these factors helps you take targeted actions to improve your score.

How to Check Your Credit Score

Knowing your credit score is the first step to improving it. You can check your score through various online platforms that offer free credit reports. It's important to check your score regularly to monitor your progress and identify any errors that may be affecting your score. If you find inaccuracies, you can dispute them with the credit bureaus. Regular monitoring helps you stay informed and take timely actions to maintain or improve your credit score.

Steps to Improve Your Credit Score

Improving your credit score involves several strategic actions. Start by paying your bills on time, as this is the most significant factor affecting your score. Reducing your debt is another crucial step; aim to keep your credit utilization below 30%. Avoid opening new credit accounts unless necessary, as multiple inquiries can lower your score. Consider using a secured credit card to build or rebuild credit. Over time, these actions can significantly improve your credit score.

The Role of Credit Counseling

If you're struggling to manage your credit, consider seeking help from a credit counseling service. These services can offer personalized advice and strategies to improve your credit score. They can help you create a budget, manage debt, and understand the factors affecting your credit. While some services are free, others may charge a fee. Ensure you choose a reputable service to avoid scams and further financial stress.

Common Credit Score Myths

There are many myths surrounding credit scores that can lead to misunderstandings. One common myth is that checking your own credit score will lower it; however, this is not true. Another myth is that closing old accounts will improve your score. In reality, closing accounts can shorten your credit history and negatively impact your score. Understanding the facts about credit scores can help you make informed decisions to improve and maintain a healthy score.

Long-Term Benefits of a Good Credit Score

Maintaining a good credit score offers numerous long-term benefits. It can save you money through lower interest rates on loans and credit cards. A high score can also make it easier to rent an apartment, secure a job, and even get better insurance rates. The effort you put into improving and maintaining your credit score will pay off in various aspects of your financial life. A good credit score is not just a number; it's a key to financial freedom and stability.